ct sales tax online

Connecticut Sales Tax Ranges. Either your session has timed-out or you have performed a navigation operation Ex.

Online Sales Tax Bills Gaining Traction

Sale of most motor vehicles for more than 50000.

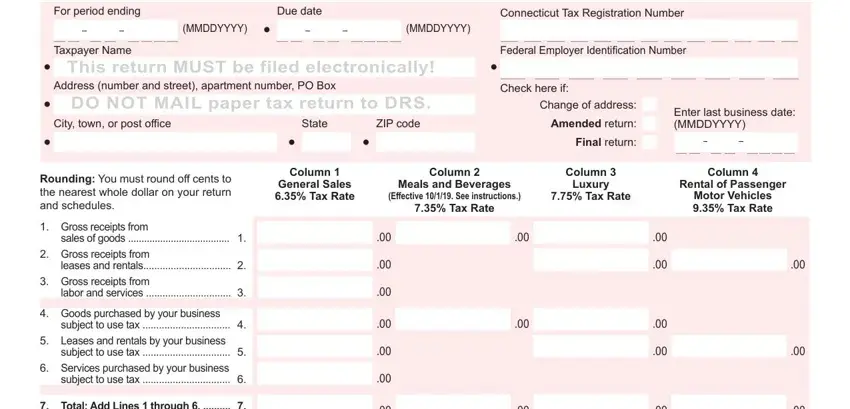

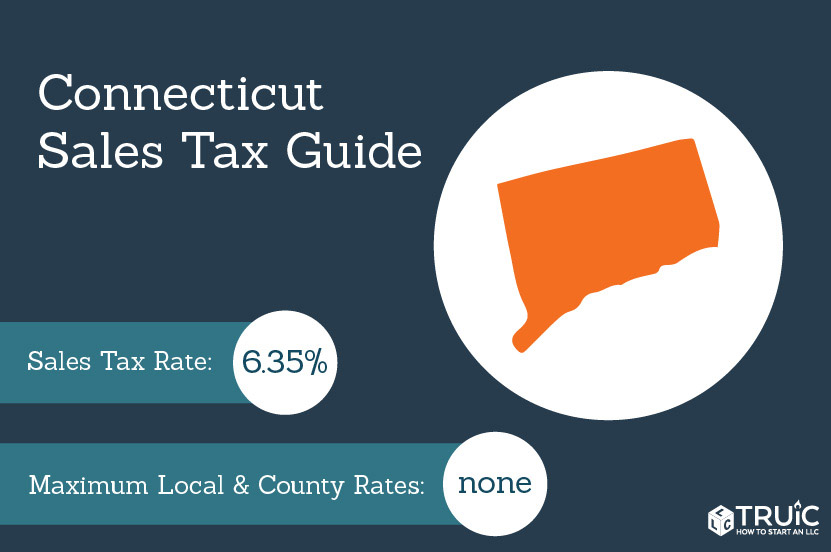

. Connecticut has a hodge-podge system that includes a base sales tax rate of 635. We cover more than 300 local jurisdictions. While it is highly recommended that you file online using the Connecticut Taxpayer Service Center website it is possible to file your.

The Connecticut state sales tax rate is 635 and the average CT sales tax after local surtaxes is 635. Jewelry whether imitation or real. You can register for a Connecticut sales tax permit online or you may do so in person at one of the Department of Finances local field offices.

Fill out form REG-1 and. The same goes if you have nexus in Connecticut because you sell. Groceries prescription drugs and non-prescription drugs are exempt from the.

Baltic CT Sales Tax Rate. Beacon Falls CT Sales Tax Rate. A sales and use tax rate of 299 applies to the sale of vessels motors for vessels and trailers used for transporting a vessel.

A luxury rate of 775 on high-priced jewelry and motor vehicles. A 1 surcharge on. Connecticut Department of Revenue Services - Time Out.

Connecticut has a statewide sales tax rate of 635 which has been in place since 1947. Rental or leasing of passenger motor vehicles for 30 days or less. See Special Notice 201851 Legislative Changes Affecting.

No matter if you live in Connecticut or out of state charge a flat 635 in sales tax to your customers in Connecticut. Register online at the MyConnectCT. Create a Tax Preparer Account.

Using Back Button of the browser that is not. Upon submitting your application you will. The current state sales tax rate in.

How to get a sales tax permit in Connecticut. Filing Your Connecticut Sales Tax Returns Offline. Ballouville CT Sales Tax Rate.

Combined Sales Tax Range. You have several options to register for your Connecticut sales tax permit. Bantam CT Sales Tax Rate.

Base State Sales Tax Rate. Bethany CT Sales Tax Rate. For tax preparers CPAs and filing practitioners who manage multiple business accounts for multiple clients.

Local Sales Tax Range. Municipal governments in Connecticut are also allowed to collect a local-option sales tax that.

Connecticut Sales Tax Handbook 2022

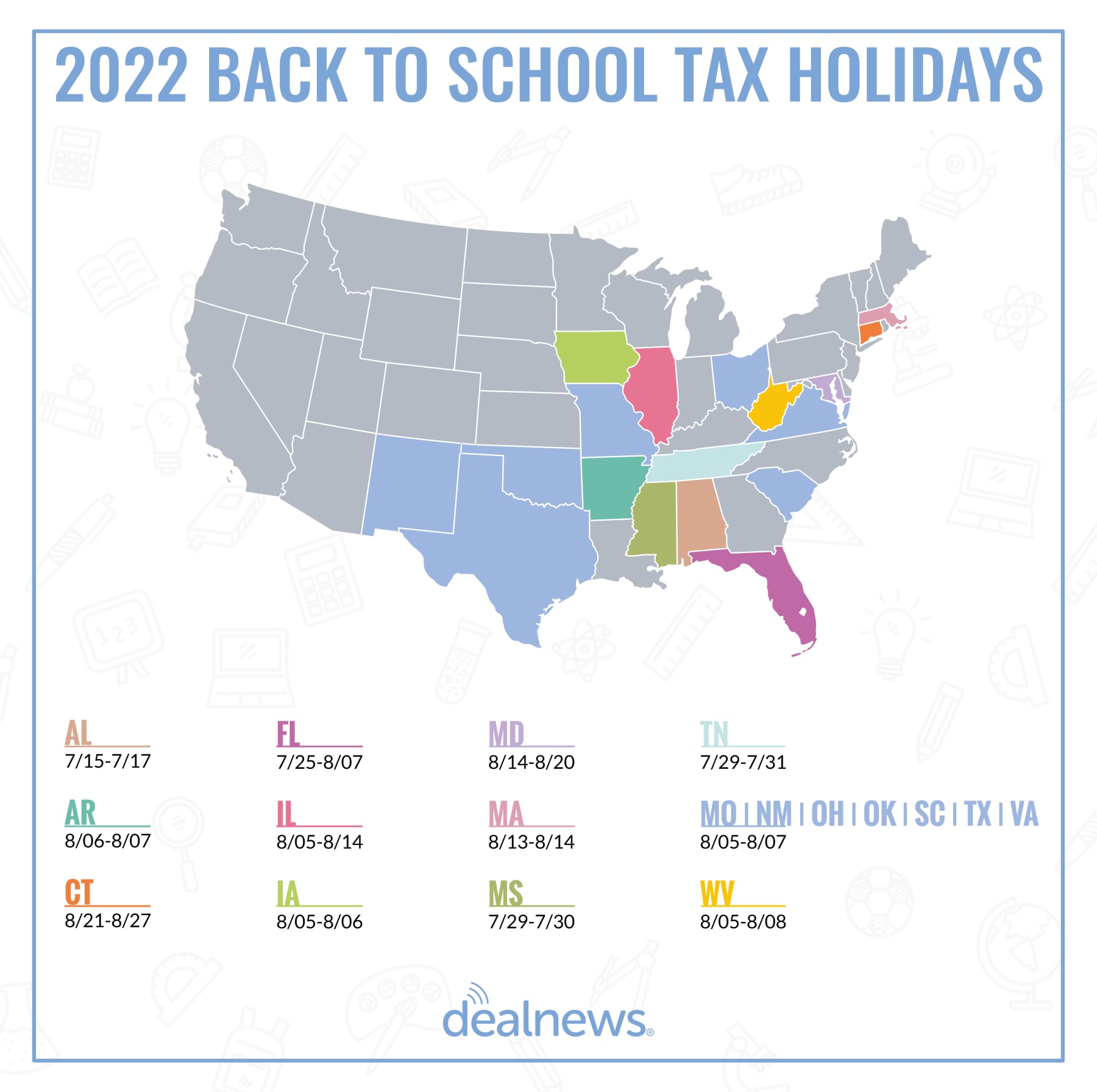

When Is Your State S Tax Free Weekend In 2022

Fillable Online Cultureandtourism Au 677 Declaration Of Payment Of Connecticut Sales And Ct Gov Cultureandtourism Fax Email Print Pdffiller

Connecticut Department Of Revenue Services

Ct Form Os 114 Fill Out Printable Pdf Forms Online

Ct Form Os 114 Sut Fill Online Printable Fillable Blank Pdffiller

How To Register For A Sales Tax Permit Taxjar

Connecticut Department Of Revenue Services

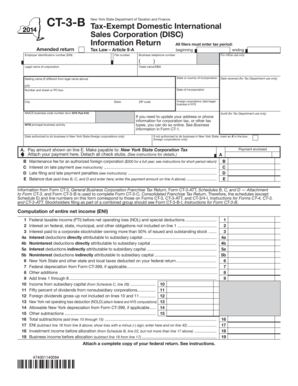

Fillable Online Tax Ny Form Ct 3 B 2014 Tax Exempt Domestic International Sales Tax Ny Fax Email Print Pdffiller

State Creates Myconnect To Help Business Owners Navigate Tax Filing

Ct Sales Tax Chart Fill Out Sign Online Dochub

Connecticut Sales Tax Small Business Guide Truic

How To File And Pay Sales Tax In Connecticut Taxvalet

Ct Never Came Up With A Plan To Collect More Online Sales Tax

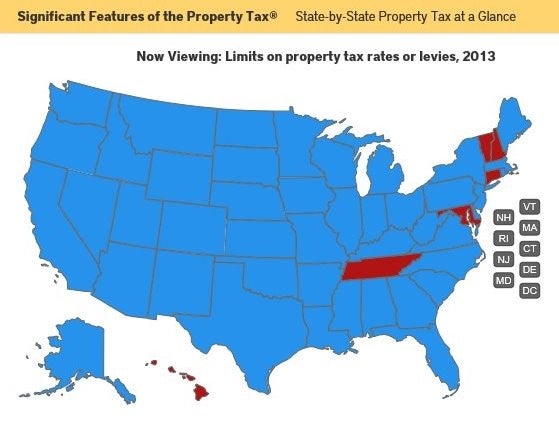

New Online Resource State By State Property Tax At A Glance Lincoln Institute Of Land Policy

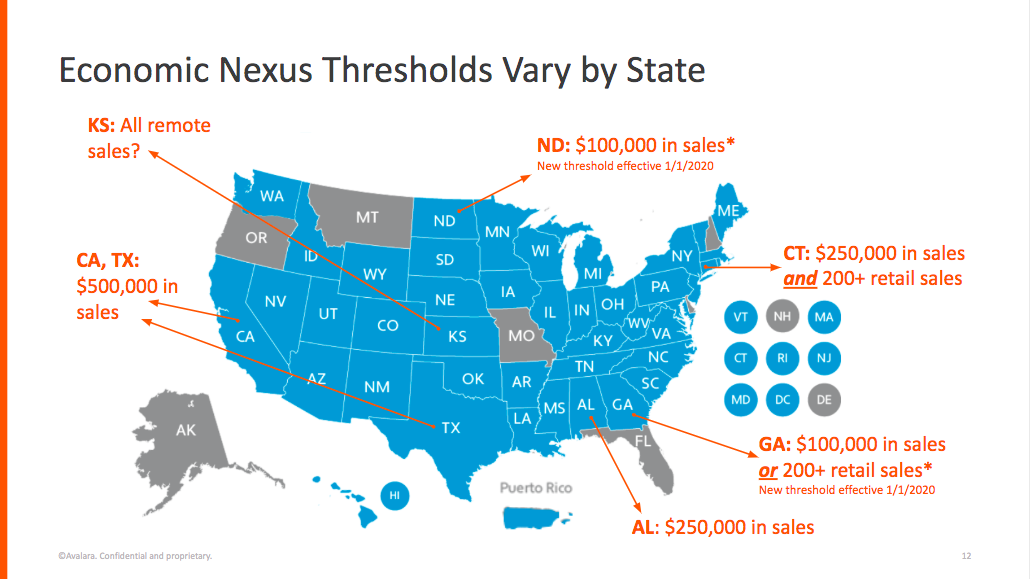

The Accountant S Guide To Ecommerce Sales Tax Rules The Appy Hour With Liz Heather

How To Register For A Sales Tax Permit In Connecticut Taxvalet